Increasing your savings by just 1% now could mean a lot in retirement.

Jeanne Thompson, senior vice president of retirement insights at Fidelity puts it best in her article on saving for retirement.

“Small steps now can turn into big strides later”.

In speaking with people on saving for retirement, I find that most of us are guilty of set it and forget it. When we first enroll in a 401 (k) plan, we elect a certain dollar amount or percent of salary deferral on an ongoing payroll basis and don’t revisit. As this article details, it is important to review that level of contribution each year and increase it gradually year by year. Just 1% more certainly can make a big difference!

Key takeaways

✓ Consistently saving a little bit more can add up over time.

✓ Whether it’s $10 or $100, saving money early in life, doing it consistently, and increasing the amount you’re able to save over time can help you live the life you want in retirement.

Often it’s the little things in life that can make the biggest difference. That’s true when it comes to saving for retirement. Putting just 1% more into a tax-advantaged retirement account like a 401(k), 403(b), or an IRA could make a noticeable difference in your lifestyle in retirement. Whether you choose to make Roth or traditional contributions, the benefits of saving just a little more now can pay off later.

Read Viewpoints on Fidelity.com: Traditional or Roth account—2 tips for choosing.

“Saving for retirement may seem like a steep mountain to climb, but the climb doesn’t have to be as steep as it looks,” says Jeanne Thompson, senior vice president of retirement insights at Fidelity. “Small steps now can turn into big strides later.”

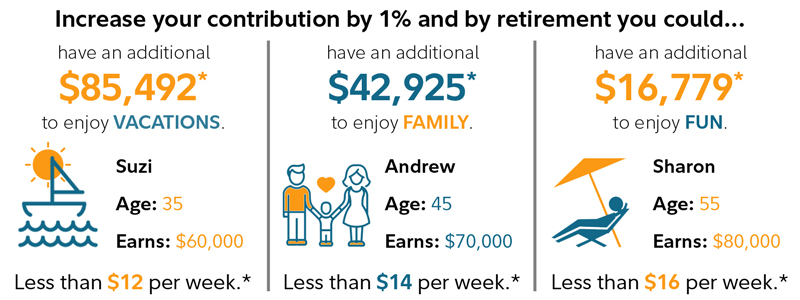

While 1% is a small percentage of your annual earnings today, after 20 or 30 years it can make a big difference in your account balance when you retire. That’s because the longer you give your money a chance to grow, the better. And it works no matter how old you are—or how far off retirement is.

Let’s look at some examples.

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

*Approximation based on a 1% increase in contribution rate. Continued employment from current age to retirement age, 67. We assume you are exactly your current age (in whole number of years) and will retire on your birthday at your retirement age. Number of years of savings equals retirement age minus current age. Nominal investment growth rate is assumed to be 5.5%. Hypothetical nominal salary growth rate is assumed to be 4% (2.5% inflation + 1.5% real salary growth rate). All accumulated retirement savings amounts are shown in future (nominal) dollars. This assumes no loans or withdrawals are taken throughout the current age to retirement age.

Your own plan account may earn more or less than this example and income taxes will be due when you withdraw from your account. Investing in this manner does not ensure a profit or guarantee against a loss in declining markets.

Investing involves risk, including the risk of loss

See your numbers

Want to create an example like the ones shown above to see what a difference even a 1% increase can make for you? Use our interactive tool. See how a small change can make a BIG DIFFERENCE.

Consider small steps

As you can see in our examples—and probably in your own too—small weekly amounts like $12, $14, and $16 can make a noticeable difference in your savings. So how do you find the money? We won’t say to skip buying something if you really need it, but there are probably places in your spending that may be easy to cut. Even bringing your lunch or using coupons could save you $16 or more. And the beauty of 401(k) contributions is that they come right out of your paycheck, so you may not even miss the spending money.

If a one-time bump-up isn’t ideal now, consider aiming to increase contributions each year. For instance, if your 401(k) lets you set automatic increases every year, consider signing up. If you usually get a raise each year, you may be able to time the increase to happen when you get a bump in pay so you won’t feel the impact in your paycheck.

Consider saving 15%

We ran the numbers and determined that aiming to save 15% of income toward retirement annually—which includes any matching contributions or profit sharing an employer may make to a workplace retirement account like a 401(k) or 403(b)—can help ensure that you can maintain your lifestyle in retirement.

Read Viewpoints on Fidelity.com: How much should I save each year?

Not saving that much? Don’t fret. Few people get there overnight. Think of planning for retirement as a journey. The key is to save as much as you can now and try to increase savings over time. If possible, save at least enough to get any match from your employer.

“Starting early, saving regularly, and increasing the amount you save as your income increases will help you to achieve the retirement you envision,” says Thompson.

Don’t have a 401(k)?

You may be self-employed or maybe your employer doesn’t offer a 401(k). But you can save in a tax-advantaged account like an IRA. There are several types of IRAs.

If you are already contributing to an IRA, you may not be saving up to the limits. In 2019, there is a $6,000 limit for those under age 50 and the $7,000 limit for those age 50 or older. Saving $50 more a month, or $600 a year, can make a real difference in the long run.

See how you’re doing

We made it easy to begin measuring how you are doing when it comes to saving for retirement. Answer 6 simple questions to get The Fidelity Retirement ScoreSM. It’s like a credit score for retirement. Whatever your score, you can take some simple, clear steps to stay on track or improve it.

Go for it

Challenge yourself to save a little more. Whether it’s a 1%, 3%, or even 5% increase, the extra money saved today could make a big difference in helping achieve the retirement you envision. Think about it this way: Do you want to be worrying about money in retirement?

Source: Original Article