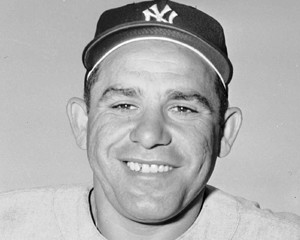

As the late, great philosopher Yogi Berra is alleged to have said, “it is hard to make predictions, especially about the future.” And, as it relates to the stock market, volatility doesn’t make predictions any easier. The word itself can connote many things, unpredictability and uncertainty, for example, but also liveliness. In a superb piece for marketwatch.com, Mitch Tuchman writes persuasively on the subject of an upside for market volatility: “It’s that time of the trading year when nobody seems to know what to make of the numbers. Stocks are down, bonds feel high, the economy sends mixed signals. Desperate for direction — any direction — investors attempt to guess the next move of the Federal Reserve (raise rates at last? stick to nearly zero?) or dabble in bottom-fishing as best they can. Assuming the bottom is in. Real retirement investors, meanwhile, are just about the only people in this market who can relax, and the data shows us why: Stock volatility is a great thing for long-term investors.

As the late, great philosopher Yogi Berra is alleged to have said, “it is hard to make predictions, especially about the future.” And, as it relates to the stock market, volatility doesn’t make predictions any easier. The word itself can connote many things, unpredictability and uncertainty, for example, but also liveliness. In a superb piece for marketwatch.com, Mitch Tuchman writes persuasively on the subject of an upside for market volatility: “It’s that time of the trading year when nobody seems to know what to make of the numbers. Stocks are down, bonds feel high, the economy sends mixed signals. Desperate for direction — any direction — investors attempt to guess the next move of the Federal Reserve (raise rates at last? stick to nearly zero?) or dabble in bottom-fishing as best they can. Assuming the bottom is in. Real retirement investors, meanwhile, are just about the only people in this market who can relax, and the data shows us why: Stock volatility is a great thing for long-term investors.

Other excerpts from his piece:

“When stocks dip, the impulse among many active managers is to sell off and buy bonds. We’ve seen that a lot over the summer, of course. But what is the long-term return for each asset class?

“For an all-bond portfolio dating back to 1926, it’s 5.1%. For an all-stock portfolio, it’s 9.9%. That’s a huge difference.

“It’s huge because of compounding. If you had $100,000 in the all-bond portfolio at that rate of return and left it alone to reinvest for three decades, you’d end up with $458,730. Which is fine.

“If you own the all-stock portfolio and reinvest dividends at the higher stock market return, the final result is $1,879,971 — nearly four times the money!

“The price you pay for that ride is volatility. The stock market is more than five times more volatile than the bond market.

“If you look back over the years since 1926, the all-bond portfolio saw a correction of more than 10% just one time. Just one.

“The stock portfolio corrected 11 times. If you’re a serious long-term investor, however, you stay in during declines and buy more through rigorous rebalancing. Nevertheless, some of those declines would test your nerve for sure. You need only think back to 2009 and the shivers set in fast.

“The answer is a risk-adjusted portfolio. Over the past several decades, the model has been a simple split of stocks and bonds that moves steadily toward fixed income as the saver nears retirement age.

“That way, you got as much of that ‘good’ stock volatility as possible without taking the risk of a stiff drop in the stock market right before retirement.”