Remember the 3 A’s for retirement saving: Amount, Account, and Asset mix.

We all know the importance of saving; whether it’s for a car, a vacation, a house or a myriad of other priorities. When retirement is far off and you have many current financial obligations, it can be difficult to focus on the future. However, now is the time to take that first step to secure your financial future and saving for retirement with the 3 A’s in mind can certainly help. Ken Hevert, Fidelity senior vice president of retirement, shares some very interesting points in this article.

Key takeaways

✓ Amount: Aim to save at least 15% of pre-tax income each year toward retirement.

✓ Account: Take advantage of 401(k)s, 403(b)s, HSAs, and IRAs for tax-deferred or tax-free growth potential.

✓ Asset mix: Investors with a longer investment horizon should have a significant, broadly diversified exposure to stocks.

No one needs to tell you that you need to save for your future—hopefully, you’re already doing it. After all, no matter your age and how far away retirement is, you want to be able to enjoy retirement and do the things you want without having to worry about money.

“It’s important to focus on 3 main things during your working years: the amount you save, the accounts you save in, and your asset mix,” says Ken Hevert, Fidelity senior vice president of retirement. “Of the 3, of course, the first is the most important, as no account or asset mix can make up for not saving enough.”

1. Amount: How much and how long

We suggest starting early and consider saving at least 15% of pre-tax income each year toward retirement to help ensure enough in savings to maintain your current lifestyle in retirement.

The good news: That 15% savings rate includes any matching or profit sharing contributions from your employer to your 401(k) or other workplace savings account, like a 403(b) or governmental 457(b) plan. An employer match can make saving 15% easier. For example, Elaine earns $50,000 a year and her employer match is 100%, up to 6% of pay, which means her employer will match her contributions dollar for dollar, up to 6% of her salary. To save 15% of her salary, or $7,500, she would need to contribute only 9%, or $4,500. Her employer would be contributing $3,000, or 6%, for her.

Of course, the longer you wait to start saving, the more important it is to take advantage of every opportunity to contribute the maximum to your 401(k)—which may be more than 15% of income. The most you can contribute to your 401(k) in 2019 is $19,000. If you are age 50 or over, you can make catch-up contributions of up to $6,000, bringing the limit up to $25,000.

The maximum IRA contribution in 2019 is $6,000—if you’re over age 50, you can make catch-up contributions of up to $1,000.

Health savings accounts (HSAs) are another type of tax-advantaged account. In order to open an HSA, you generally need to be enrolled in an HSA-eligible high deductible health plan (HDHP). If only you are enrolled in the HDHP, you can contribute $3,500 to an HSA for 2019. The contribution limit for family coverage is $7,000. If you are age 55 or over, you can also make a $1,000 catch-up contribution.

Even if you can’t contribute 15% of your income right now, make sure to contribute enough to get the entire employer match in a workplace account, which is effectively “free” money, and then try to step up your savings as soon as you can.

Read Viewpoints on Fidelity.com: Just 1% more can make a big difference

2. Account: Where you save

Be sure to make the most of retirement savings accounts like 401(k)s, 403(b)s, and IRAs. If you have an HDHP, consider taking advantage of health savings accounts (HSAs), which can offer one of the most effective means of saving for qualified medical expenses now and in retirement. Your contributions to these accounts can grow tax-deferred or tax-free.

With a traditional 401(k) or IRA your contributions are pre-tax, which means that they generally reduce your taxable income and, in turn, lower your tax bill in the year you make them. Your contributions won’t avoid taxes entirely; you’ll pay income taxes on any money you withdraw from your traditional 401(k) or IRA in retirement.

A Roth 401(k) or IRA works the opposite way. Contributions are made after-tax, with money that has already been taxed, and you generally don’t have to pay taxes when you withdraw from your Roth 401(k) or Roth IRA.1

So how does a person determine which type of 401(k) or IRA to contribute to—a traditional or Roth account? There are several things to consider, but for many, the answer comes down to a simple question: Am I better off paying taxes now or later? For those who expect their tax rate in retirement to be higher than their current rate, tax-free withdrawals from a Roth 401(k) or IRA might be a better choice. On the other hand, for those who expect their tax rate to go down in retirement, a traditional 401(k) or traditional IRA may make more sense.

For those who can, it may make sense to contribute to both a traditional and a Roth account. That can provide the flexibility of taxable and tax-free options when it comes time to take withdrawals in retirement, which can help manage taxes. Those who aren’t sure of their future tax picture could choose to make both types of contributions.

Read Viewpoints on Fidelity.com: Traditional or Roth account? 2 tips to choose

It’s important to note that if you get an employer match or profit-sharing contribution from your employer, those contributions are always to a traditional 401(k)—even if you are making only Roth 401(k) contributions. So you may already be contributing to both types of accounts.

Alternative saving options to consider:

|

The cost of health care in retirement continues to increase so it can be a good idea to prepare specifically for those expenses. Fidelity estimates a typical 65-year-old couple retiring today will need, on average, $285,000 saved (in a taxable account) to pay for out-of-pocket health care costs in retirement.3 Saving in an HSA can reduce the amount you need because contributions, earnings, and withdrawals are tax-free when used to pay for qualified medical expenses.

If you have an HSA, consider contributing money above and beyond the amount you think you’ll need for the current year’s health care expenses. If you’re able to invest some of it for the future, you may have some of your future health care expenses covered.

3. Asset mix: How you invest

Stocks have historically outperformed bonds and cash over the long term. So when investing for a goal like retirement that is years away, it can make sense to have more invested in stocks and stock mutual funds. But higher volatility also comes with investing in stocks, so you need to be comfortable with the risks.

We believe that an appropriate mix of investments should be based on your time horizon, financial situation, and tolerance for risk. As a general rule, investors with a longer investment horizon should have a significant, broadly diversified exposure to stocks.

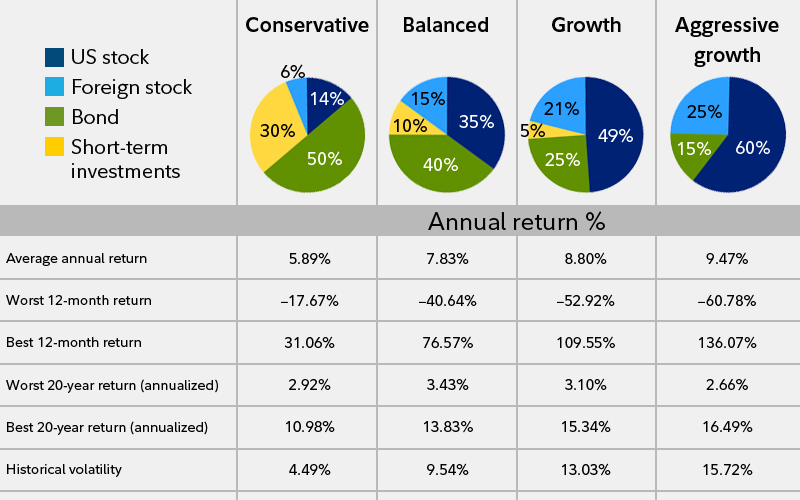

Take a look at our 4 investment mixes (see chart below) and how they performed historically over a long period of time. As you can see, the conservative mix has historically provided much less growth than a mix with more stocks, but less volatility too. Having a significant exposure to stocks that’s appropriate for your investing time frame may help grow savings.